Chat with your peer at a sister facility in another state, and you may discover you pay more for Boca Terry waffle robes, or less for slippers. You both buy the same model, from the same supplier—us. Why the price difference?

The difference is called Nexus, and it’s a tax matter. Nexus is easy to understand broadly, and we explain that below. Implementing it? Not so easy, but that’s our job, not yours.

What is Nexus?

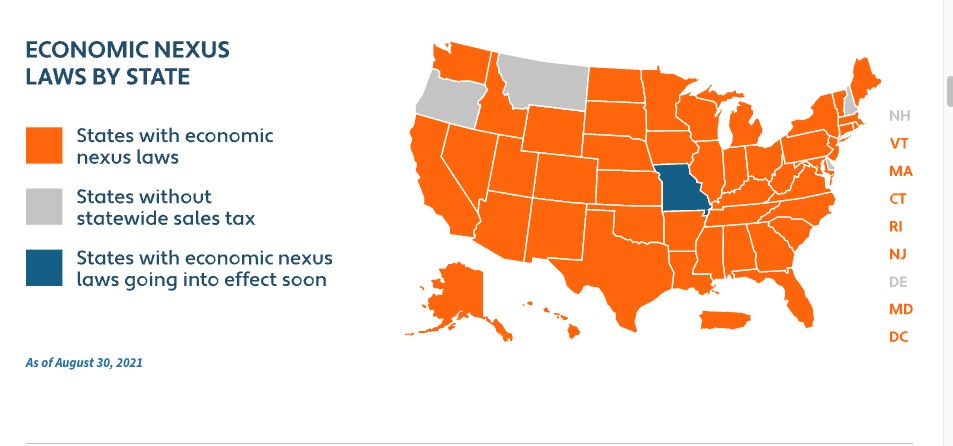

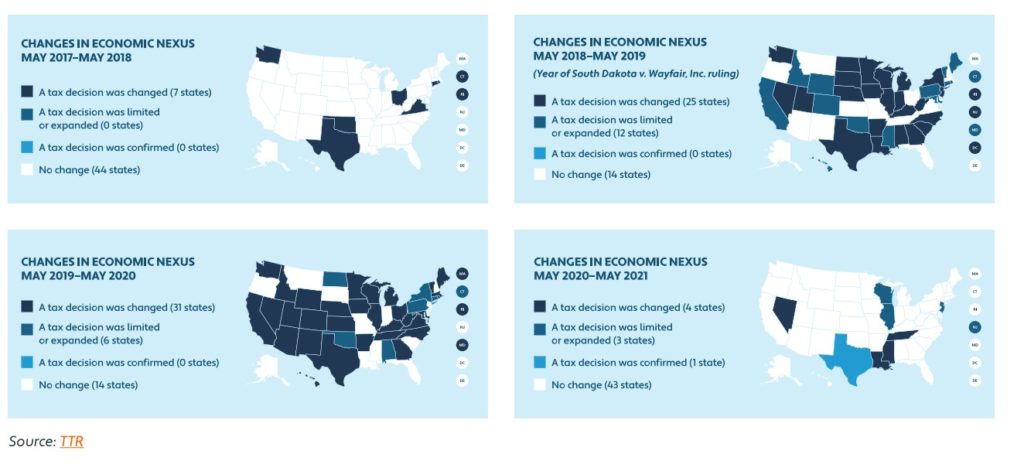

Nexus is a term used to describe state-by-state taxing issues. It dates to 2018, following the U.S. Supreme Court decision on South Dakota V. Wayfair, Inc. Essentially, “Wayfair,” as it’s called, said that companies from one U.S. state selling a lot of goods in another U.S. state needs to charge sales tax.

As you know, towns, cities, counties and states often charge sales tax for retail and wholesale transactions. More than 11,000 U.S. jurisdictions collect tax, in fact. As online commerce grew in recent times (think: Amazon), small retailers were losing sales. Jane’s Boutique, say, had to tack on a sales tax of maybe 6 percent, while out-of-state companies like Amazon didn’t. Once free shipping became commonplace, customers could get goods for less money online than near home. So they chose the online option, which hurt mom-and-pop storefronts.

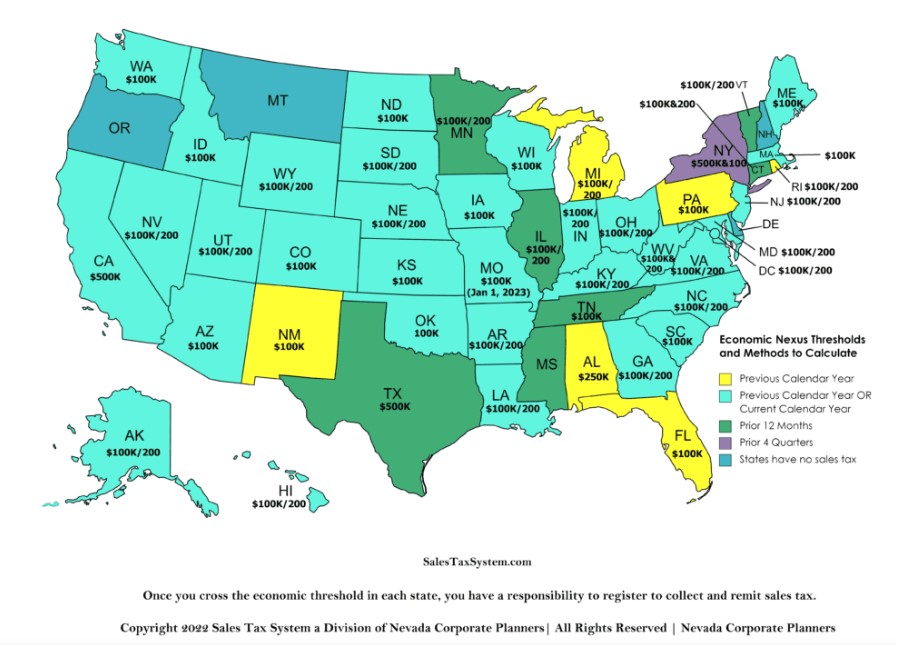

The Nexus rule applies when a company does a lot of business in another state. In some cases, the threshold that requires charging sales tax is determined an “economic connection,” which means it sold over a financial threshold for the year, such as $100,000, or had 200 sales transactions. Each state has its rules.

Local jurisdictions get involved too. Counties, cities and towns often charge sales tax. Under Nexus, out-of-state companies might be required to add on those taxes too, when selling away from their home base.

Physical Presence Matters

While the Nexus situation mostly revolves around taxes, it also encompasses satellite business operations in another state. Boca Terry is based in Florida, for example. We’ve always charged sales tax to Florida clients. Now, in some circumstances, we’ll have to add a Nexus tax if we have a small office in another state, and that might be a sales rep’s home office; an employee who lives elsewhere in the United States; or if we have a factory, fulfillment center, drop-shipping facility, distributor or warehouse elsewhere in the country. If one or more of our team attends a trade show in Indiana or California? That might involve a Nexus tax situation too.

It gets more complicated. Some jurisdictions froze Nexus enforcement during the heart of the pandemic; some have since started it up again.

To help sellers pay taxes correctly, several companies specialize in calculating the mishmash of rules across the nation. Some even have online tax calculators that tally the full amount. State taxing authorities have the info too.

But, the numbers have changed every year, so Nexus obligations remain challenging to track.

What Does This Mean for You?

Back to that chat with your colleague: You may be charged a 5 percent sales and use tax for your Boca Terry robes while your colleague pays 6.5 percent. We don’t choose that amount; we simply apply whatever the law dictates.

That’s the new normal.