That’s great news overall, but price and supply worries still burden the hospitality industry. We’ve faced similar challenges in the past and always rebounded in a dynamic way. We’ll do it again.

The Industry Today

After hunkering down at home during the heart of the pandemic, people are traveling for vacation and for their jobs. We see it here in South Florida, where, in Fort Lauderdale alone, 2022 business travel revenue was 9% higher than back in 2019. And leisure travelers? They spent 35 percent more here this year, according to a recent study by the American Hotel and Lodging Association and Kalibri labs.

An international response to so-called cabin fever fueled this increase, post-pandemic. Hotels are filling up and cruise lines are experiencing robust occupancy. American tourists are tending to stay in the United States, in part due to Covid-related travel restrictions and instabilities in some parts of the world.

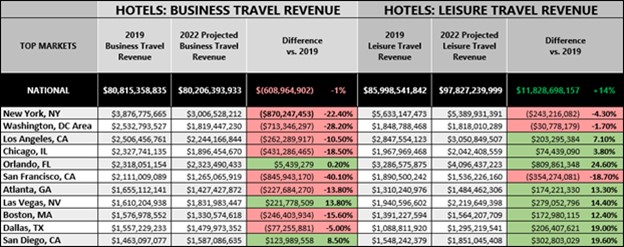

While business travel revenue nationwide dipped 1 percent in 2022 versus 2019, tourist dollars rose 14 percent. Orlando, Las Vegas, San Diego, Phoenix, Nashville and a few other hot spots were deemed likely to gain more tourists and corporate types, the study shows. The same is happening around the world, from San Diego to Singapore.

Numbers for the top 11 U.S. markets are listed below.

Look at the Numbers

While the hospitality industry is thrilled to welcome customers back, we also face challenges. Let’s call it a good news/bad news scenario. After all, visitors bring traffic on local roads, competition for seats in favorite restaurants and, currently, staffing issues.

Before addressing those, let’s look at more statistics.

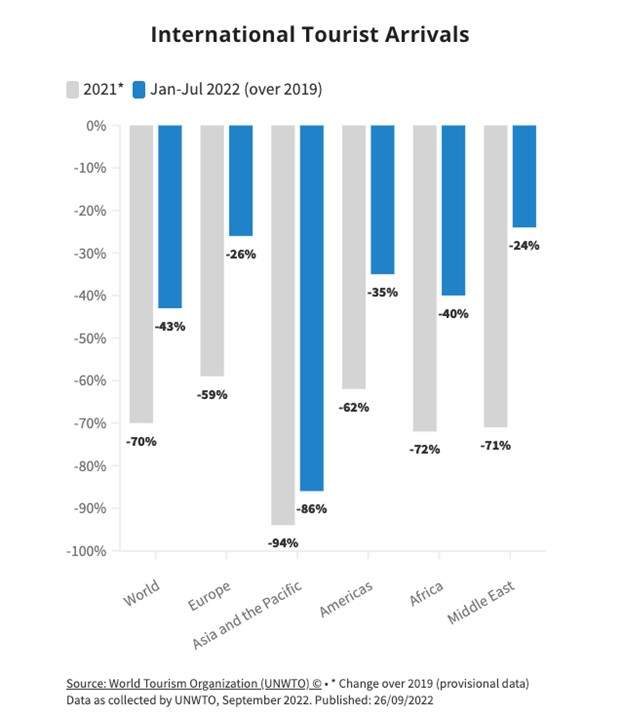

This situation is not limited to North America. Internationally, tourism in the first seven months of 2022 was up 57 percent over the same period the year before, according to The World Tourism Organization (UNWTO). “An estimated 474 million tourists traveled internationally [in the first seven months of 2022], compared to the 175 million in the same months of 2021,” UNWTO reports.

UNWTO points to Europe and the Middle East as reaping the big games, with arrivals up 74 percent and 76 percent, respectively. The Americas, Africa, Asia and the Pacific also saw large increases.

Why Business Travel Lags

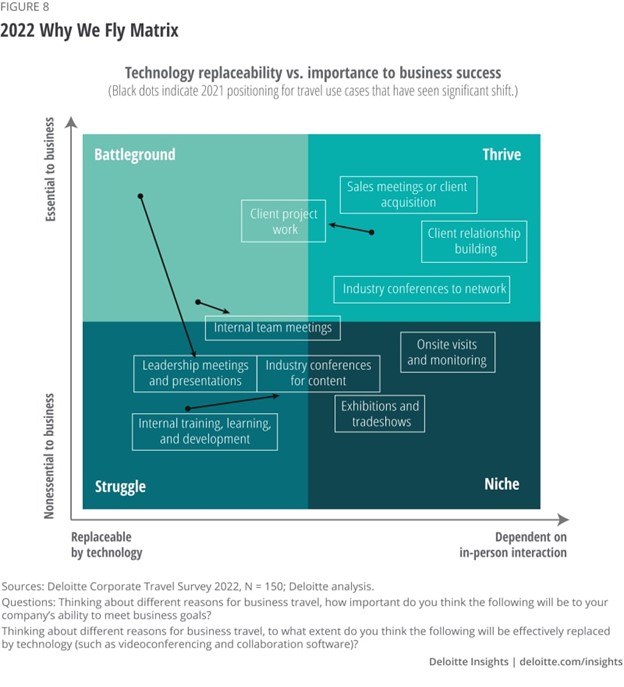

Referring to “caveats” regarding travel’s return, in an April report Deloitte cited baby steps in seeing business travelers back on the road. “Team meetings that have been postponed multiple times will finally take place. More conferences will shift back from online to in-person, and those that already have will likely see attendance improve. Even international trips should grow significantly, although some regions will recover faster than others,” says the consulting firm in “Reshaping the Landscape: Corporate Travel in 2022 and Beyond.”

Executives understand the benefits of travel, yet aren’t convinced employees need to leave their desks as much as they did. “COVID-19 appears to be fading as a primary daily concern,” Deloitte’s study points out, noting that the threat of variants still colors corporate travel decisions. “The prospects of last-minute meeting cancellations, or being stuck overseas, further exacerbate the challenges to reinvigorating international corporate travel,” it says. The war in Ukraine might also affect travel decisions, the report notes.

The Great News

As a manufacturer of robes, sheets, towels and other soft goods for luxury hotels and spas, Boca Terry certainly sees an uptick in our sales. That’s consistent with the general optimism in the local hospitality sector, and it makes sense: You have more and more guests in your rooms, so you need extra towels, linens and robes.

What We’re Up Against

We’re not where we were in 2019, though, as our business, our community and the world readjust after such a trying three years.

Controlling prices is difficult. Some factors can’t be overlooked, such as the ever-increasing cost of labor, high energy prices and the fear of a recession.

The ongoing disruption in the supply chain is another key reason for increased prices. Ports continue to be jammed up, resulting in products staying in storage rather than getting to market. There’s a shortage of truck drivers, too. Once on land, goods might sit for awhile before moving to their final destination. That makes it more expensive for manufacturers to do business, which ultimately gets passed on to the consumer. Room rates, airline tickets and food cost more for these reasons and more—all legitimate, yet all off-putting to consumers.

Hopefully that, too, will sort itself out soon.

Right now, consumers are willing to pay extra for the freedom to travel. So many of us have started tipping more, and conceding to higher room rates even though services such as daily housekeeping might but cut. That attitude of acceptance — as a reaction to the pandemic — will eventually wane with a return to a more budget-conscious approach to travel. Moving forward, the industry must find ways to make travel and accommodations more affordable.

This industry has always been resilient and it will continue to be so as it serves tourists and business travelers from around the world.

Based on experience, we feel hopeful about the future. If the past is an indicator, this innovative and vibrant industry will find ways to sustain its recent improvement and overcome some of the troubling obstacles.

Edward and Bruce Cohen